Customs procedures for equipment, machinery, construction vehicles, means of transport, molds and samples temporarily imported for re-export, temporarily exported for re-import for production, construction, construction and installation Existing project, testing.

- April 22, 2023

| Procedure name | Customs procedures for equipment, machinery, construction vehicles, means of transport, molds and samples temporarily imported for re-export, temporarily exported for re-import for production, construction, construction and installation Existing project, testing. |

| Decision issued | 671 |

| How to perform | Electronic |

| Resolution deadline | + Time limit for receiving, registering, and checking customs documents: immediately after the customs declarant submits and presents customs documents in accordance with the law (Clause 1, Article 23 of the Customs Law) + Time limit Complete the document check and physical inspection of goods and means of transport: ++ Complete the document check no later than 02 working hours from the time the customs authority receives complete documents custom; ++ Complete the physical inspection of goods no later than 08 working hours from the time the customs declarant fully presents the goods to the customs authority; In case the goods are subject to specialized inspection in terms of quality, health, culture, animal and plant quarantine, and food safety according to relevant laws, the time limit for completing the physical inspection is The validity of goods is calculated from the time of receiving specialized inspection results according to regulations. In case the shipment has a large quantity, many types or the inspection is complicated, the head of the customs office where customs procedures are carried out shall decide to extend the time for physical inspection of goods, but the extension time is Maximum no more than 02 days. |

| Implementation object | Organization. |

| Implementing agencies | Border gate Customs Branch, Express Delivery Customs Branch, Customs Branch where the production facility or project is located or Customs Branch convenient for machinery, equipment, tools and means of service Processing contracts, export production, and operations of export processing enterprises. |

| Result | Confirm customs clearance and liquidation of declarations. |

| Fees and charges | 20,000 VND/declaration. |

| Requires implementation conditions | + The time limit for temporary import - re-export, temporary export - re-import is implemented according to the agreement between the trader and the partner and registered with the customs authority. In case it is necessary to extend the time limit for temporary import or temporary export for production, construction, project implementation, or testing as agreed with the partner, the customs declarant shall notify the Customs Branch in writing. place to carry out temporary import and temporary export procedures. + In case the temporary import or temporary export deadline has passed and the customs declarant has not re-exported or re-imported, he/she will be handled according to the provisions of law. + In case a temporary import or temporary export enterprise has a written request to sell, give or donate equipment, machinery, construction vehicles, means of transport, molds, samples temporarily imported for re-export, temporarily exported for re-import Customs procedures must be carried out for exported and imported goods. |

| Legal grounds | – Customs Law No. 54/2014/QH13 dated June 23, 2014 of the National Assembly;

– Clause 23 Article 1 Decree No. 59/2018/ND-CP dated April 20, 2018 amending and supplementing Article 50 of Decree No. 08/2015/ND-CP dated January 21, 2015 of the Government detailing and implementing measures implementing a number of articles of the Customs Law on customs procedures, inspection, supervision and control. – Circular No. 39/2018/TT-BTC dated April 20, 2018 of the Ministry of Finance on customs procedures, inspection, supervision and control; – Circular No. 274/2016/TT-BTC dated November 14, 2016 of the Ministry of Finance regulating collection rates, collection, remittance, management and use of customs fees and fees for goods and vehicles in transit . |

| The order of execution | + Step 1: The customs declarant registers and carries out customs procedures;

+ Step 2: The customs authority reviews and decides to clear the customs declaration for the declarant. + Step 3: Liquidate the declaration of temporary import - re-export, temporary export - re-import after all goods are re-exported or re-imported. |

| Profile components | 1. Customs documents for equipment, machinery, construction vehicles, transportation vehicles, molds and samples temporary import for re-export:

a) Customs declaration according to the form issued by the Ministry of Finance; b) Transport documents in case of goods transported by sea, air or rail: 01 photocopy; c) Import license, written notification of specialized inspection results according to relevant laws: 01 original copy. 2. Customs documents for equipment, machinery, construction vehicles, transportation vehicles, molds and samples temporary export for re-import: a) Customs declaration according to the form issued by the Ministry of Finance; b) Export license, written notice of specialized inspection results according to relevant laws: 01 original copy. |

| Number of records | 01 set |

| Name of the declaration form | + Customs declaration according to the Appendix issued with Circular No. 39/2018/TT-BTC dated April 20, 2018 of the Ministry of Finance; |

| Attachments |

SEN TRONG LOGISTICS LOGISTICS CO., LTD

Phone: (+84) 28-2218.7777 // (+84) 28-2219.7777

Website: https://whitelotuslogistics.com.vn

Email: sales777.whitelotus@whitelotuslogistics.com.vn

Contact: Ms. Tran Thi Thuy Trang – CEO

Hotline: (+84) 903.712.368

Related Posts

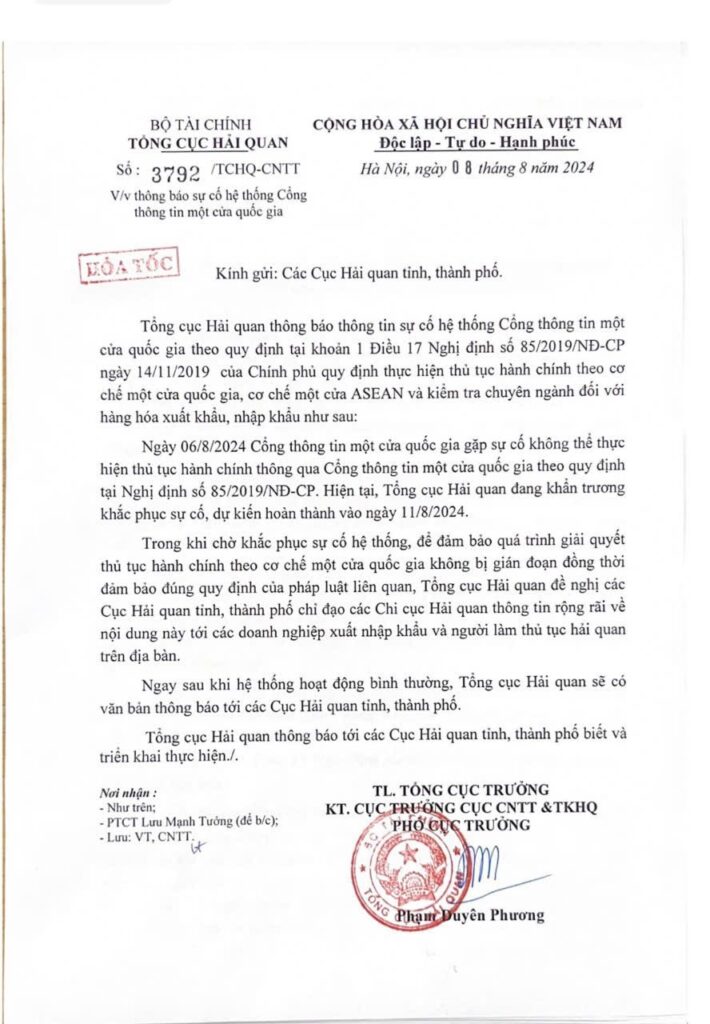

Urgent CV to notify the National Single Window Portal system incident.

VAT is further reduced by 2% until the end of this year

ABOUT TAX POLICY ...... ACCORDING TO OFFICIAL DISpatch 706/TCHQ-TXNK DATED FEBRUARY 22, 2024

NO. 01/2024/TT-BNNPTNN, February 2, 2024

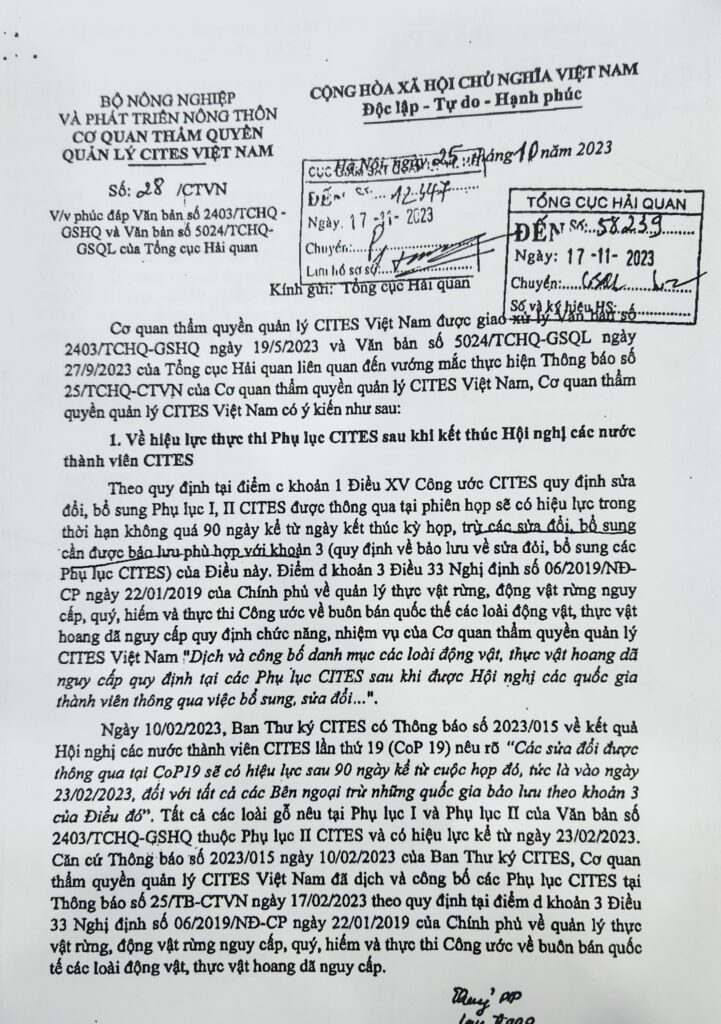

Official dispatch amending CITES

Method of calculating export tax and import tax 2024

Subjects subject to export tax and import tax 2024

Procedures for pre-determination of customs value 2024

Allocation of 2024 adjustments

Adjustments except 2024

Adjustments plus 2024

Special relationship

Whatever you need, we're here to help

Logistics solution

We meet the needs of customers of the supply chain.

Contact us

Our team of dedicated professionals is here for you.

Request a quote

Request an inland tariff quote from us.