Procedures for extension of customs clearance agent number

- April 22, 2023

| Procedure name | Procedures for extension of customs clearance agent number |

| Decision issued | Decision No. 1325/QD-BTC dated August 5, 2019 |

| How to perform |

– Submit application directly; – Send documents by post; – Online public services. |

| Resolution deadline | Within 03 working days from the date of receiving a complete application for extension of the enterprise's customs clearance agent code. |

| Implementation object | Businesses, individuals |

| Implementing agencies |

a) Authority with decision-making authority: General Department of Customs b) Authority or competent person authorized or decentralized to implement (if any): No c) Agency directly implementing administrative procedures: General Department of Customs. d) Coordinating agency (if any): No |

| Result | Customs clearance agent employee number or written response in case of ineligibility. |

| Fees and charges | Are not |

| Requires implementation conditions | – Customs clearance agent staff are not included in the recalled cases; – Customs clearance agent staff have participated in a training course to supplement customs law knowledge with a minimum duration of 03 days (8 periods/day) provided by Vietnam Customs School or colleges and universities. The academy has a specialized customs department to implement it, on the basis of agreeing on the training program with the General Department of Customs. |

| Legal grounds |

– Customs Law No. 54/2014/QH13 dated June 23, 2014; – Circular No. 12/2015/TT-BTC dated January 31, 2015 of the Ministry of Finance detailing procedures for granting customs declaration professional certificates; issuance and revocation of customs clearance agent employee codes; order, recognition procedures and operations of customs clearance agents. – Circular No. 22/2019/TT-BTC dated April 16, 2019 of the Minister of Finance amending and supplementing a number of articles in Circular No. 12/2015/TT-BTC dated January 31, 2015 of the Ministry Finance Detailed regulations on procedures for granting customs clearance certificates; issuance and revocation of customs clearance agent employee codes; order, recognition procedures and operations of customs clearance agents. |

| The order of execution | – Step 1: Documentation:

Customs clearance agents have expired codes to carry out customs procedures and are not in the cases of having their customs clearance agent codes revoked. The customs clearance agent prepares a dossier to request extension of the customs clearance agent code and sends it to the General Department of Customs. - Step 2: Renewal of customs clearance agent employee code: The General Department of Customs receives and checks documents and conditions according to regulations; The Director General of the General Department of Customs renews the code of customs clearance agents. In case the conditions are not met, there will be a written response from the business. |

| Profile components |

– Application for extension of customs clearance agent employee code according to form No. 07A issued with the Circular: 01 original copy; – Certificate of completion of training course to supplement customs law knowledge: 01 photocopy. – Identity card/Citizen identification card (In case the national population database has not yet been put into operation): 01 photocopy; – One (01) 2×3 color photo taken within 6 months. Photocopy documents must be signed and stamped by the legal representative of the customs clearance agent or notarized or authenticated by a competent authority. |

| Number of records | 01 set |

| Name of the declaration form | – Form No. 07A: Application for extension of customs clearance agent code; – Form No. 08: Customs clearance agent employee card. |

| Attachments |

|

SEN TRONG LOGISTICS LOGISTICS CO., LTD

Phone: (+84) 28-2218.7777 // (+84) 28-2219.7777

Website: https://whitelotuslogistics.com.vn

Email: sales777.whitelotus@whitelotuslogistics.com.vn

Contact: Ms. Tran Thi Thuy Trang – CEO

Hotline: (+84) 903.712.368

Related Posts

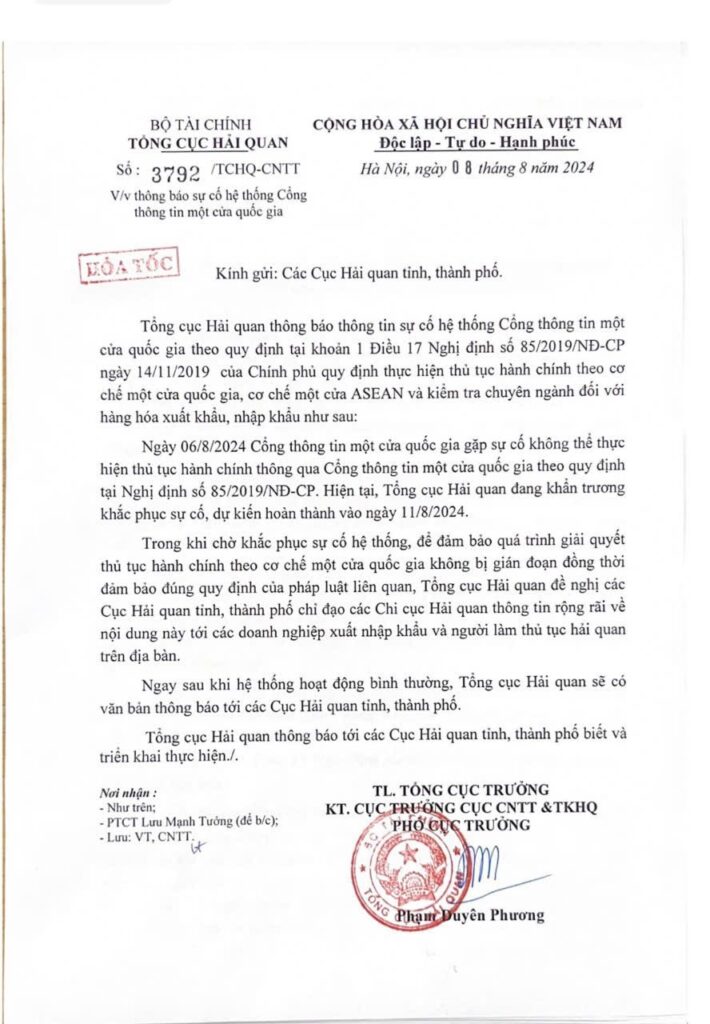

Urgent CV to notify the National Single Window Portal system incident.

VAT is further reduced by 2% until the end of this year

ABOUT TAX POLICY ...... ACCORDING TO OFFICIAL DISpatch 706/TCHQ-TXNK DATED FEBRUARY 22, 2024

NO. 01/2024/TT-BNNPTNN, February 2, 2024

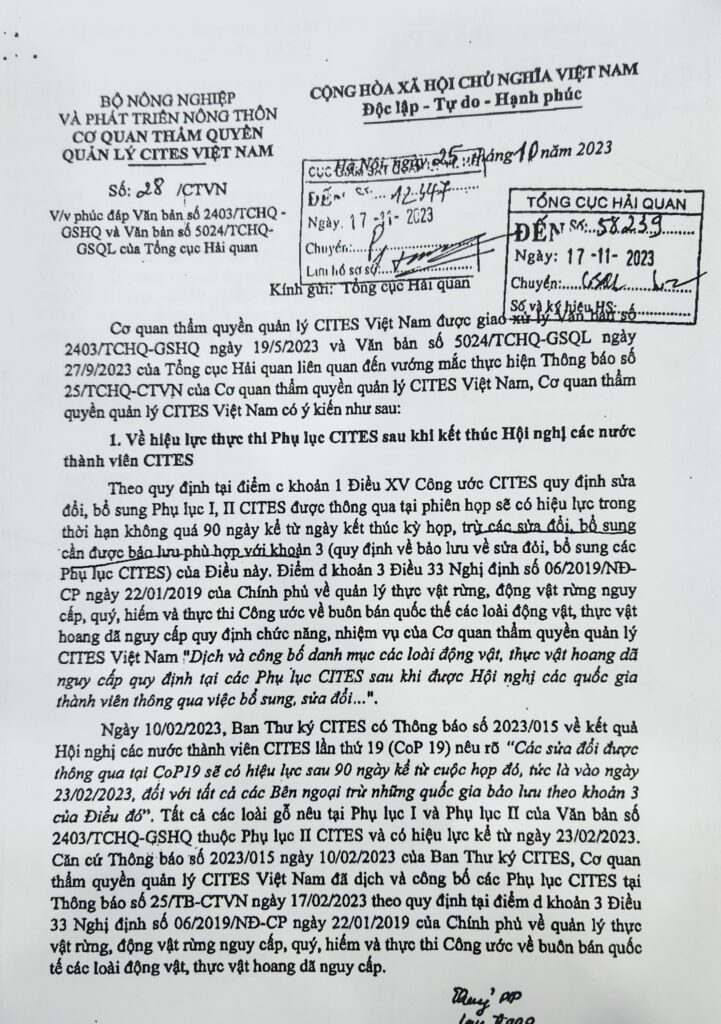

Official dispatch amending CITES

Method of calculating export tax and import tax 2024

Subjects subject to export tax and import tax 2024

Procedures for pre-determination of customs value 2024

Allocation of 2024 adjustments

Adjustments except 2024

Adjustments plus 2024

Special relationship

Whatever you need, we're here to help

Logistics solution

We meet the needs of customers of the supply chain.

Contact us

Our team of dedicated professionals is here for you.

Request a quote

Request an inland tariff quote from us.