Check the printing, issuance, management and use of Receipts

- April 24, 2023

| Procedure name | Check the printing, issuance, management and use of Receipts |

| Decision issued | Decision 272/QD-BTC dated February 14, 2012 |

| How to perform | Submit application by mail. |

| Resolution deadline | Within five (5) business days |

| Implementation object | Enterprise providing international air express delivery services |

| Implementing agencies | Authority with decision-making authority: Customs Department of the province or city where the Enterprise registers the customs declaration.

– Authority or competent person authorized or decentralized to implement (if any): – Agency directly implementing administrative procedures: Customs Department of the province or city where the enterprise registers the customs declaration. – Coordinating agency (if any): no |

| Result | Evaluate the situation of preparation, issuance, use and management of Enterprise Receipts. |

| Fees and charges | Are not |

| Requires implementation conditions | International air express delivery business is doing business. |

| Legal grounds | – Accounting Law No. 03/2003/QH11 dated June 17, 2003

– Customs Law No. 29/2001/QH10 dated June 29, 2001; Law No. 42/2005/QH11 dated June 14, 2005 amending and supplementing a number of articles of the Customs Law – Law on Tax Administration No. 78/2006/QH11 dated November 29, 2006 – Law on Electronic Transactions No. 51/2005/QH11 dated November 29, 2005; – Instructions attached. – Ordinance on handling administrative violations No. 44/2002/PL-UBTVQH10 dated July 2, 2002; Ordinance amending and supplementing a number of articles of the Ordinance on Handling of Administrative Violations No. 04/2008/UBTVQH12 dated April 2, 2008; – Fees and Charges Ordinance No. 38/2001/PL-UBTVQH10 dated August 28, 2001; – Decree No. 118/2008/ND-CP dated November 27, 2008 of the Government regulating the functions, tasks, powers and organizational structure of the Ministry of Finance; – Circular 178/2011/TT-BTC dated December 8, 2011 of the Ministry of Finance guiding the creation, issuance, use and management of tax and customs fee receipts for exported goods, Imported by Enterprises providing international air express delivery services. |

| The order of execution | – Step 1: The customs authority where the customs declaration is registered checks the creation, issuance, management and use of Receipts in the report on the use of Receipts by Enterprises. At a maximum of ten (10) working days from the date of receipt of the report on the use of the Enterprise's Receipt, the customs authority must conduct an inspection.

– Step 2: In case the customs authority inspects and detects signs of violation, within three (03) working days from the date of discovery, the customs authority shall issue a document requesting the Enterprise to report and explain. submit. – Step 3: In case the Enterprise does not explain or the explanation is not satisfactory, the customs authority issues a decision to check the Receipt at the Enterprise's headquarters. |

| Profile components | Report on the use of Receipts by the Enterprise according to Form No. 03 issued with this Circular: 01 original copy

– Explanation report (if required): 01 original copy |

| Number of records | 01 set |

| Name of the declaration form | Form No. 03 - Report on the use of tax and customs fee receipts printed by the Enterprise itself |

| Attachments | Mau-178-2011-TT-BTC-Bienlai.docx |

SEN TRONG LOGISTICS LOGISTICS CO., LTD

Phone: (+84) 28-2218.7777 // (+84) 28-2219.7777

Website: https://whitelotuslogistics.com.vn

Email: sales777.whitelotus@whitelotuslogistics.com.vn

Contact: Ms. Tran Thi Thuy Trang – CEO

Hotline: (+84) 903.712.368

Related Posts

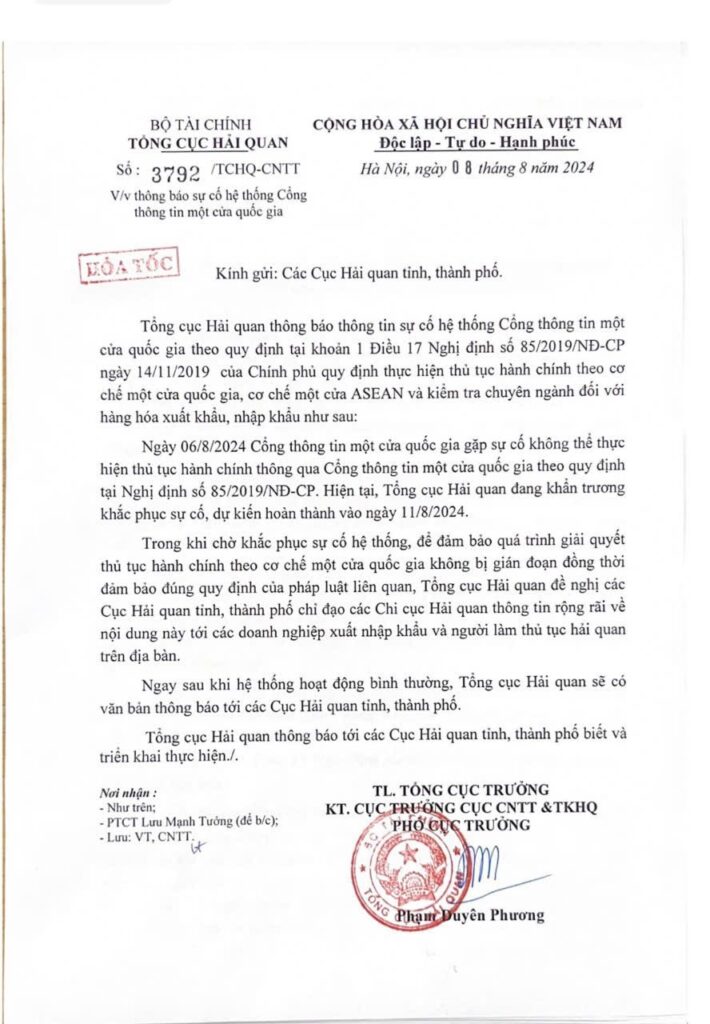

Urgent CV to notify the National Single Window Portal system incident.

VAT is further reduced by 2% until the end of this year

ABOUT TAX POLICY ...... ACCORDING TO OFFICIAL DISpatch 706/TCHQ-TXNK DATED FEBRUARY 22, 2024

NO. 01/2024/TT-BNNPTNN, February 2, 2024

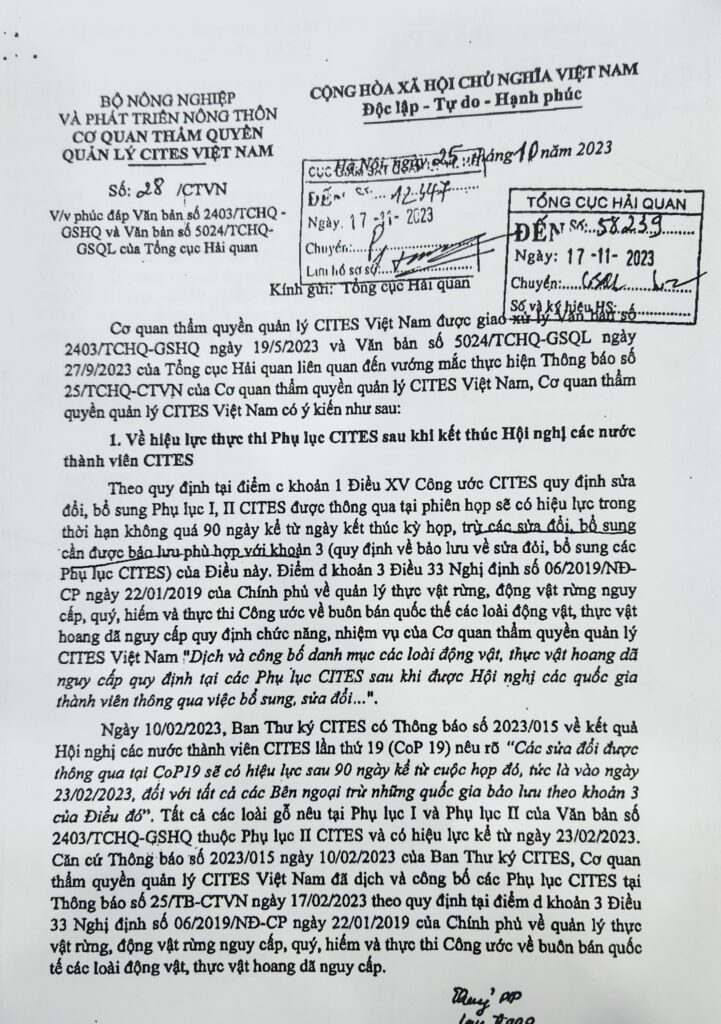

Official dispatch amending CITES

Method of calculating export tax and import tax 2024

Subjects subject to export tax and import tax 2024

Procedures for pre-determination of customs value 2024

Allocation of 2024 adjustments

Adjustments except 2024

Adjustments plus 2024

Special relationship

Whatever you need, we're here to help

Logistics solution

We meet the needs of customers of the supply chain.

Contact us

Our team of dedicated professionals is here for you.

Request a quote

Request an inland tariff quote from us.