1. Concept of C/O form VC

C/O form VC is a document used for exported goods from Vietnam and Chile. Accordingly, goods exported to this market will enjoy preferential tariffs under the Vietnam-Chile Free Trade Area Agreement (VCFTA).

Basically, Vietnamese goods use C/O form VC when they meet one of the following criteria:

- Goods have pure origin in Vietnam or are produced 100% in Vietnam.

- Fully meets the general origin criteria of the goods.

- Manufactured in Vietnam (manufactured from raw materials originating in Vietnam or Chile).

In addition to the specific provisions above, the Circular also regulates the procedures for registering trader profiles, C/O application documents, and the process and deadline for issuing C/O forms at C/O issuing organizations. of the Ministry of Industry and Trade.

2. Application for issuance of C/O form VC

Basically, the procedure for issuing C/O form VC will include a number of necessary documents as follows:

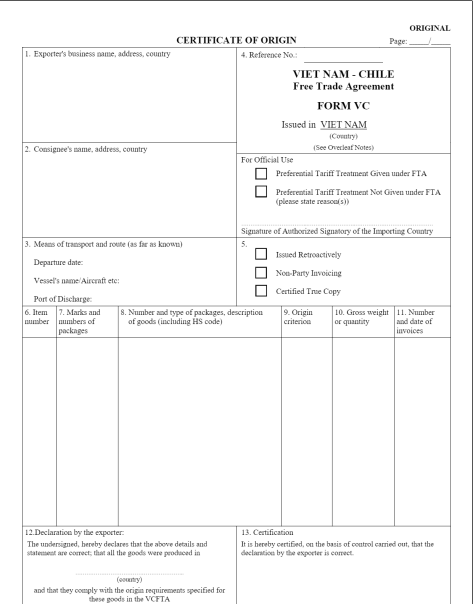

- The application for a certificate of origin is completely declared.

- C/O form VC is completed in accordance with regulations.

- Notarized copy of customs declaration (if the goods do not need customs declaration, this document does not need to be submitted)

- Notarized copy of commercial invoice.

- Bill of lading or equivalent transport document (fully notarized copy). C/O applicants may not be required to submit this document when the exported goods do not use a bill of lading or related documents.

- Declaration of exported goods meeting preferential or non-preferential origin criteria.

- Declaration of origin of the manufacturer and supplier of domestically sourced materials. Applicable in cases where the goods are used in the next stage to produce another type of goods.

- Notarized copy of the most detailed production process of goods.

- Other documents.

Note: C/O form VC will be valid within 12 months from the date it is issued by the C/O issuing organization.

3. Form C/O form VC