1. Concept of C/O Form E

C/O form E is a certificate of origin issued under the framework agreement on comprehensive economic cooperation between ASEAN member countries and China (ACFTA agreement). This document will be used to confirm that imported and exported goods originate from countries in this agreement.

If you don't know, the ACFTA (ASEAN-China Free Trade Area) agreement is an international trade agreement signed in 2004 in Laos. This agreement includes China and ASEAN member countries, and was signed to promote and strengthen economic relationships between the countries included in the agreement.

2. Procedure for applying for C/O form E for export goods

Businesses that want to apply for a C/O form E can apply online or go directly to the Department of Industry and Trade to apply. Accordingly, the steps to apply for C/O form E are carried out according to the following process:

- Step 1: Register a new account for the Enterprise for those applying for C/O for the first time;

- Step 2: Access the system ecosys.gov.vn to declare C/O documents online;

- Step 3: Next is to download required documentary information including customs declaration, bill of lading, content list, C.Inv;

- Step 4: After completing the information declaration, the proposer will perform electronic signing operations and submit the application online;

- Step 5: The application is approved and rendered, the enterprise will print the application for the issued C/O number and submit it with the application set;

- Step 6: Officials check and approve paper records and issue original C/O (Original) paper copies if the business's records are accurate.

3. Regulations for C/O form E

According to Circular 12/2019/TT-BCT of the Ministry of Industry and Trade regulating C/O form E as follows:

- C/O form E is made on white paper, A4 size according to ISO standards, in accordance with the prescribed form. C/O form E includes 1 original (Original) and 2 copies (Duplicate and Triplicate). C/O form E must be declared in English;

- If C/O form E has many pages, the following pages must have the same signature, seal, and reference number as the first page;

- Each C/O form E has a unique reference number. Issued per shipment and may include one or more items;

- The original C/O form E is sent by the exporter to the importer and submitted to the customs authority at the port or place of import. Duplicate copy kept by the C/O issuing agency or organization of the exporting member country. Triplicate copy kept by the exporter;

- If C/O form E is rejected, the customs authority of the importing Member State checks in Box 4 on C/O form E;

- In case C/O form E is rejected as stated in Clause 5 of this Article, the customs authority of the importing Member State can accept and consider the explanations of the agency or organization issuing the C/O for consideration. enjoy preferential tariffs. The explanations of the agency or organization issuing the C/O must be detailed and explain the issues raised by the importing member country.

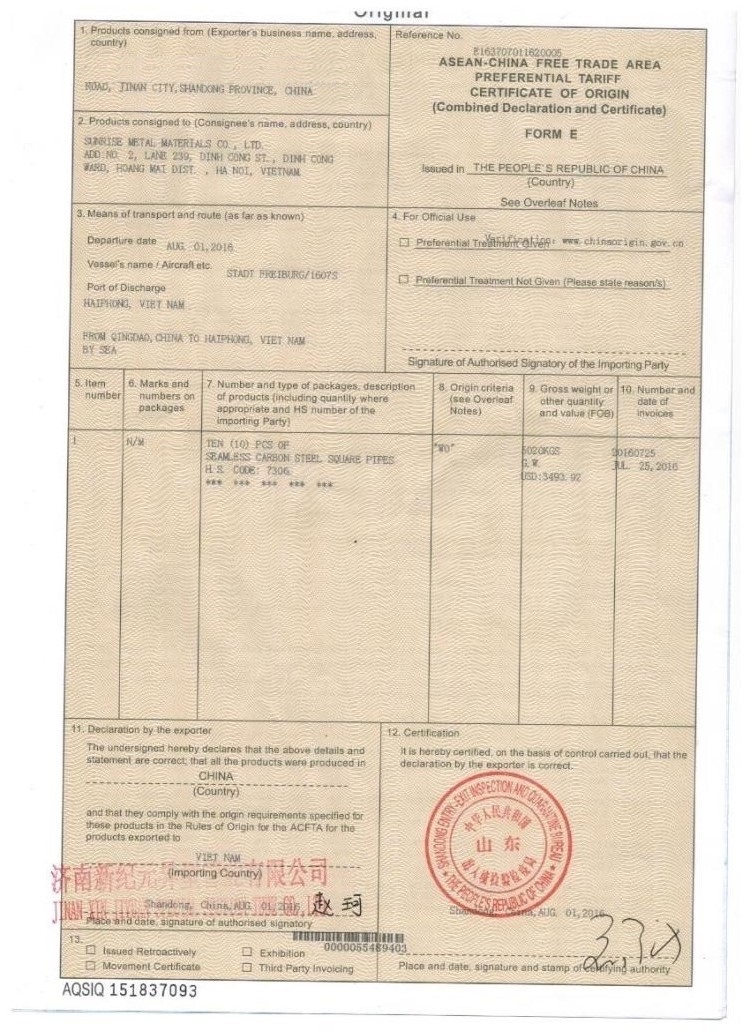

4. C/O Form E form