1. Concept of C/O Form D

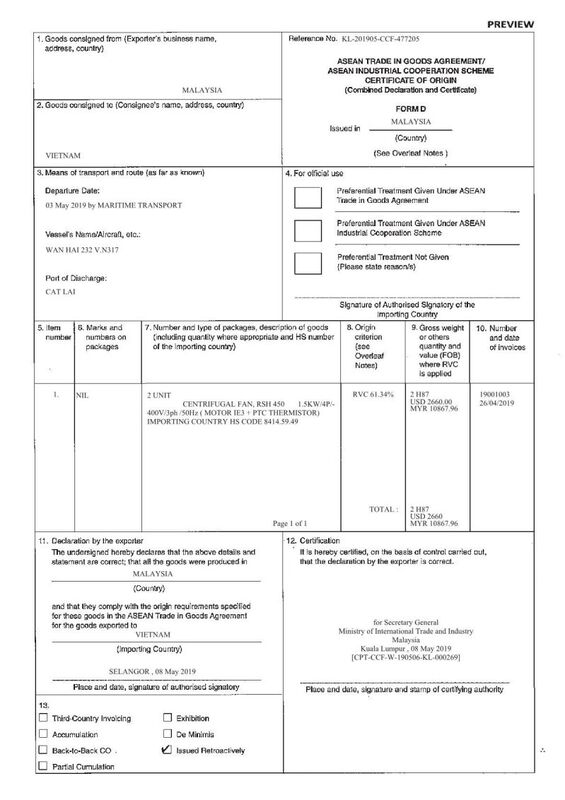

C/O form D is an export certificate issued by a competent authority for goods exported to ASEAN countries that are subject to preferential tariffs for members of the CEPT Agreement. Accordingly, the importer will present C/O to the customs authority, this unit will enjoy import tax incentives (Mostly 0%). Therefore, when exporting goods to Southeast Asian countries, importers will require the exporter to provide this C/O.

When the importer of goods presents C/O form D to the customs authority, the goods will enjoy preferential import tax (Most types of goods will be subject to import tax 0%).

In short, when goods are exported to Southeast Asian countries (ASEAN member countries), the importing party always requires the exporting party to provide this C/O form D. This can be considered a plan to promote and develop trade within ASEAN now and in the future.

2. Procedures for applying for C/O Form A

Currently C/O form D has 2 forms: paper and electronic versions. Basically, the content of C/O form D in paper and electronic versions is the same.

To apply for paper C/O form D.

To carry out the process of applying for paper C/O form D, businesses follow these steps:

Step 1: Access the website of the Ministry of Industry and Trade at the link http://ecosys.gov.vn to report information. If there is no trader registration, the business must prepare a set of trader documents for registration, then apply for an account on the Ecosys system.

Step 2: Take your order number and wait to be called at the appropriate counter.

Step 3: Submit your application to the C/O receiving officer, where you will be examined and given specific advice about the application by the C/O issuing officer.

Step 4: If the set of documents meets the requirements, the business will be issued a C/O number and receive C/O data from the Website.

Step 5: Officer signs and approves C/O/

Step 6: C/O form D will be stamped and returned to the business and one copy will be kept.

Time to issue paper C/O form D will be no more than 1-2 days work, since the enterprise submits complete documents.

Please issue C/O form D electronically

When making an electronic CO form D, all information must be declared in English or select the fields available on Ecosys. If you do not understand the regulations on how to apply for an electronic CO form D, you can declare according to the following content

- Importing country: Name of the importing country.

- Export Declaration Number and Export Declaration Attached: Enter the customs declaration number and attach.

- Good consigned from: Enter export business information about business name and address.

- Good signed to: Enter import business information including name and address.

- Transport Type: Enter the transport method.

- Port of Loading: Select port information available on the system (if not available, leave blank or add later).

- Port of Discharge: Select the discharge port location available on the system.

- Vessel's Name/Aircraft etc and Transportation document attached: Vessel name and Bill of Lading (if any).

- Departure date: Date the train departs.

- Goods: Select Add item and enter all information according to the instructions available on the computer screen.

♦After entering all necessary information on the system, the enterprise will sign the approval and it will be sent to the Export Management Department. If the application is approved, the business will also be issued an electronic C/O. At the same time, the eCoSys system will automatically send the C/O to ASEAN member countries according to the national single-window mechanism. Exporters and importers will track information and validity of C/O through the ASEAN single-window system.

3. Necessary documents to be issued C/O form D

To be issued C/O form D, you need to prepare all the following documents:

– Copy of bill of lading Bill of Lading: Copy the original (Most goods exported to Southeast Asia, exporters use surender bill. The Ministry of Industry and Trade requires a copy of the original based on the BL, draft BL is not accepted. I have seen many cases where because of this mistake, people who applied for C/O had to go back to the company to supplement).

– Original commercial invoice

– Original packing slip

– Copy of customs clearance declaration

– Copy explaining the production process of the product from input materials (Explanation of the production process of the product from input materials).

– Copy of material norms table: % of material A, % of material B... in the shipment

– Copy of domestic material purchase invoice or raw material import customs declaration when importing goods from abroad

– A copy attached to the original invoice for exported products (in case the exporting enterprise is a trading company, does not directly produce but purchases products for export).

– Application for issuance of C/O from the Ministry of Industry and Trade to implement the rules of origin in the ASEAN Trade in Goods Agreement

5. C/O Form D

![]() Download .pdf version (Buy at BCT)

Download .pdf version (Buy at BCT)