1. Concept of C/O Form B

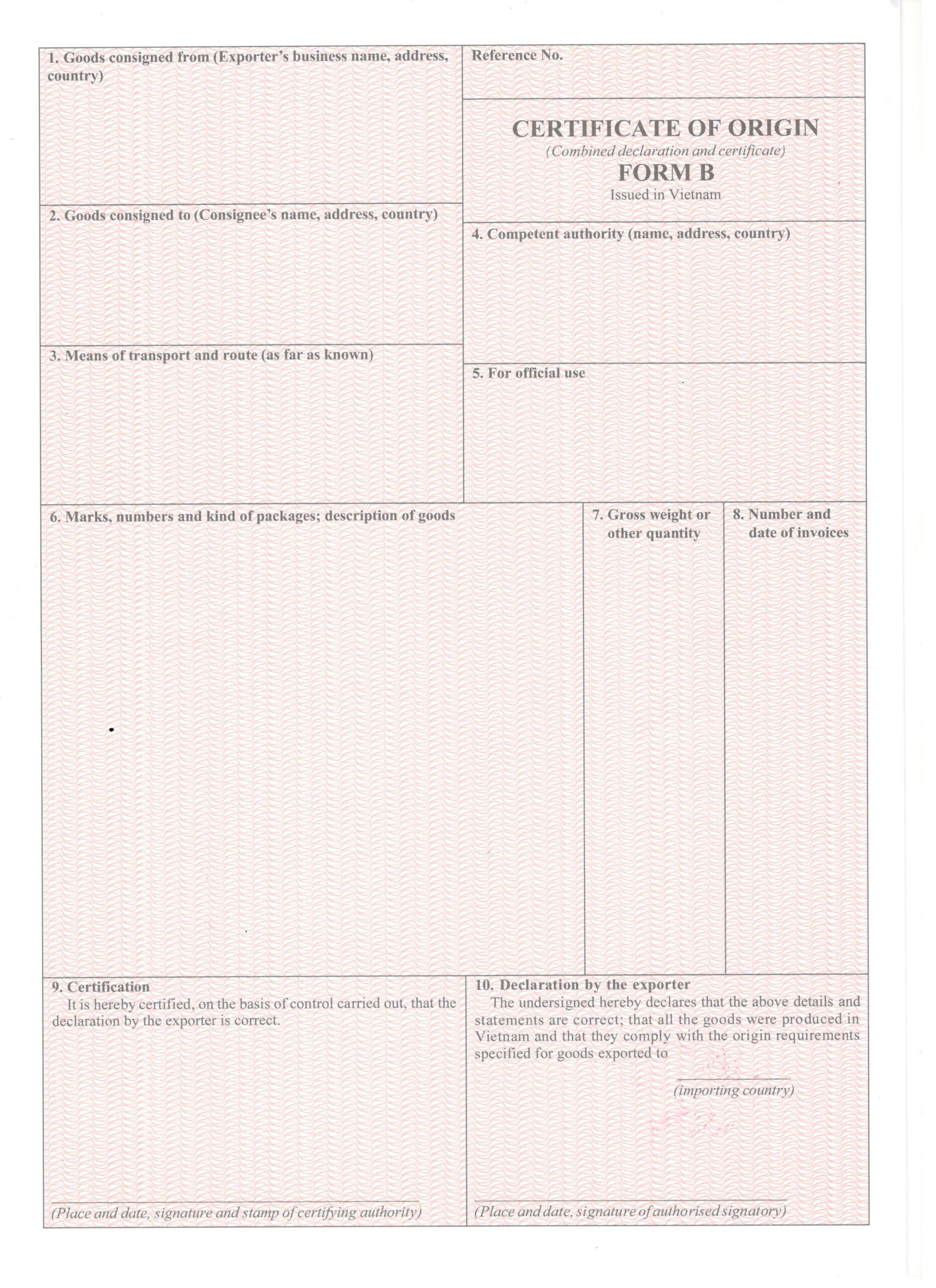

C/O form B is one of the popular types of C/O applied to goods exported to all countries, issued according to non-preferential rules of origin.

CO form B granted by Vietnam Chamber of Commerce and Industry VCCI and authorized branches.

This type of C/O paper is issued for goods originating in Vietnam exported to countries around the world in the following cases:

♦ Importing countries do not have GSP preferential regimes

♦ Importing countries have a GSP regime but do not allow Vietnam to enjoy preferential treatment

♦ The importing country has a GSP preferential regime and allows Vietnam to enjoy incentives from this regime. But Vietnam's exported goods do not meet the standards set by this regime.

Note: VCCI does not issue Certificate of Origin Form A for footwear products exported to the EU.

2. Procedures for applying for C/O Form B

Procedures for issuing C/O form B include the following documents:

- The application form for issuance of CO form B is fully declared, complete and valid

- Record sheet form B-

- The corresponding CO form B has been filled out completely and accurately -

- A copy of the customs declaration with completed customs procedures (stamped as a copy of the original by the enterprise). If the exported goods do not have to declare a customs declaration according to the provisions of law, there is no need to submit a copy of the customs declaration.

- Copy of bill of lading or copy of equivalent transport document (stamped as true copy of the trader) in case the trader does not have a bill of lading

- Copy of commercial invoice (stamped as a copy of the original by the trader)

- Copy of the goods production process (stamped as a copy of the original by the trader)

- Detailed declaration of HS codes of input materials and HS codes of output products (for criteria for converting commodity codes or criteria for specific processing stages)

- Copy of sales contract or copy of value-added invoice for purchase and sale of domestic raw materials and auxiliary materials (stamped as true copy of the trader) in case domestically purchased raw materials and auxiliary materials are used in production process.+If there is no sales contract or value-added invoice for domestic raw material purchases, confirmation from the seller or confirmation from the local government where the raw materials are produced is required. materials, goods.

- A copy of the customs declaration for importing raw materials and auxiliary materials used to produce exported goods (stamped as a true copy of the trader) in case imported raw materials and auxiliary materials are used in the production process. export goods.

- Export license (if any)

- Other necessary documents and vouchers (if any).

3. Procedure for applying for C/O Form B

– Step 1 : Enterprises declare documents on the Comis system and scan attached document files

– Step 2: The VCCI system automatically issues a C/O number after the enterprise completes the declaration. Then the business system will receive the C/O number. When there is no confirmation from the C/O officer, the enterprise can still edit the records.

– Step 3: Once completed, the enterprise will proceed to send the application to VCCI

– Step 4: VCCI receives applications from businesses

– Step 5: C/O officer reviews the application, if

+ Incomplete profile: move to step 6

+ Full profile

– Step 6: The C/O officer rejects the application and enters the reason for rejection. Enterprises, after receiving the refusal notice, proceed to edit and supplement documents as required. The process returns to step 3.

– Step 7: After reviewing the complete dossier, VCCI officials approve the issuance of C/O to the enterprise and send a notification to the enterprise.

– Step 8: After being signed and stamped by VCCI, the C/O form will be returned to the business.