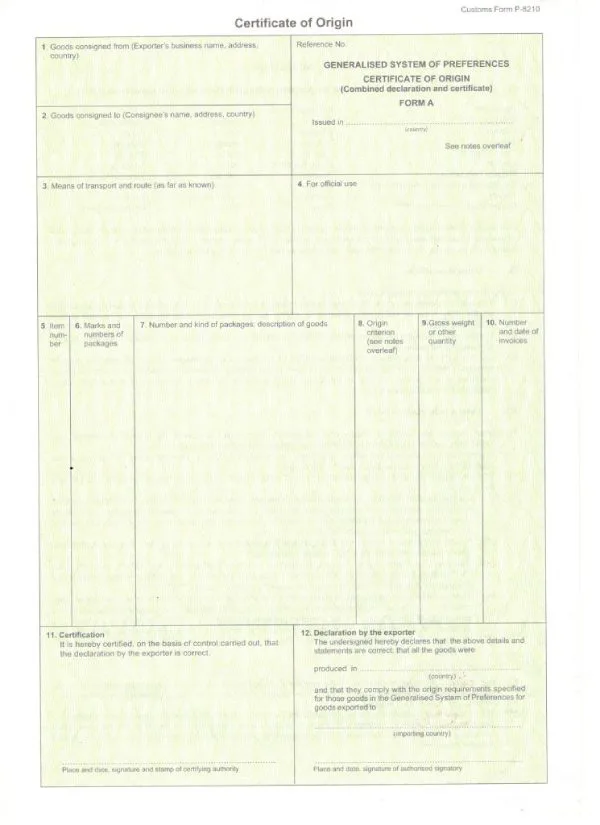

1. Concept of C/O Form A

Certificate of Origin Form A (C/O Form A) is a typical type of Certificate of Origin, issued under the Universal System of Preferences (GSP – Generalized System of Preferences). With this Certificate of Origin, exported goods will enjoy GSP preferential tax rates of the importing country. This list of countries includes 28 EU member states, Norway, Japan, Canada, New Zealand, Russia and Belarus. The list of these countries is written on the back of C/O form A.

In Vietnam, this C/O form is only issued when goods are exported to one of these countries; The goods meet the origin standards set by this country and the importing country has allowed Vietnam to enjoy preferential treatment from GSP.

Note: VCCI does not issue Certificate of Origin Form A for footwear products exported to the EU.

2. Procedures for applying for C/O Form A

Businesses that want to apply for C/O form A need to prepare some documents as follows:

– Copy of ocean bill of lading (Bill of Lading)

– Original hcommercial invoice (Commercial Invoice)

- Original packing slips (Packing List)

- Copy customs declaration

- Copy production process explanation

- Copy Table norms Consumption of raw materials (specify % of raw materials)

- Copy Raw material purchase invoice(Enterprises purchasing raw materials domestically) or customs declaration for importing raw materials (enterprises directly importing)

- Copy Invoice for sale and purchase of exported productsu, accompanied by the original for comparison (exporting enterprises do not directly produce but purchase products to export)

– Application for issuance of C/O form A: declare online and print out on the website or print from the business COMIS system

3. Procedure for applying for C/O Form A

– Step 1: Enterprise declares documents on the Comis system and scans attached document files

– Step 2: The VCCI system automatically issues a C/O number after the enterprise completes the declaration. Then the business system will receive the C/O number. When there is no confirmation from the C/O officer, the enterprise can still edit the records.

– Step 3: Once completed, the enterprise will proceed to send the application to VCCI

– Step 4: VCCI receives applications from businesses

– Step 5: C/O officer reviews the application, if

+ Incomplete profile: move to step 6

+ Full profile

– Step 6: C/O officer rejects the application and enters the reason for rejection. Enterprises, after receiving the refusal notice, proceed to edit and supplement documents as required. The process returns to step 3.

– Step 7: After reviewing the complete dossier, VCCI officials approve the issuance of C/O to the business and send a notification to the business.

– Step 8: After being signed and stamped by VCCI, the C/O form will be returned to the business.

4. Time limit for issuance of Certificate of Origin (C/O) Form A

– In Vietnam, C/O form A is issued by the Vietnam Chamber of Industry and Commerce (VCCI) and the Ministry of Industry and Trade.

– Time to issue C/O form A:

+ If the business submits a complete and valid application, the C/O will be issued on the same day. This period may be extended no more than 3 days in case of necessity

+ In case verification is required at the production facility, the C/O officer will notify the exporter in advance and extend no more than 7 days from the date of application submission.

– C/O issuance fee: free

5. C/O Form S