Procedures for actual inspection of customs inspection and supervision conditions for export processing enterprises (including enterprises with new investment projects and expansion investment projects)

- April 19, 2023

| Procedure name | Procedures for actual inspection of customs inspection and supervision conditions for export processing enterprises (including enterprises with new investment projects and expansion investment projects) |

| Decision issued | 764/QD-BTC |

| How to perform | Submit directly or by post to the Customs Branch where the export processing enterprise is managed. |

| Resolution deadline | Within a maximum period of 10 working days from the date of receipt of the notification from the export processing enterprise. |

| Implementation object | Export processing enterprises and investors implementing investment projects register as export processing enterprises |

| Implementing agencies | Customs Branch |

| Result | Form No. 26 - Certificate of satisfaction/non-satisfaction of inspection and supervision conditions of customs authorities for non-tariff zones that are export processing enterprises |

| Fees and charges | No specified |

| Requires implementation conditions | – Customs inspection and supervision conditions for export processing enterprises that are non-tariff zones must fully meet the following conditions: a) There is a hard fence separating it from the outside area; There are entrance and exit gates/doors to ensure that goods can be brought in and out of the export processing enterprise only through the gate/door. b) Have a camera system that can monitor positions at the entrance/exit gate and goods storage locations at all times of the day (24/24 hours, including holidays). , holiday); Camera image data is connected online to the customs agency managing the enterprise and is kept at the export processing enterprise for at least 12 months. The Director General of the General Department of Customs is responsible for promulgating the format of data messages exchanged between customs authorities and enterprises regarding surveillance camera systems to comply with the provisions at point b above. c) Have software to manage non-taxable imported goods of export processing enterprises to report import-export-inventory settlement on the use of imported goods according to customs laws. – At least 30 days before the export processing enterprise officially comes into operation as stated in the Investment Registration Certificate, Adjusted Investment Registration Certificate (if any) or document of the investment registration agency Competent investment in cases where it is not required to issue an Investment Registration Certificate or a written confirmation from the investment registration agency regarding the time the export processing enterprise officially comes into operation is behind schedule compared to the schedule. At the time stated in the above documents, the export processing enterprise sends a notification that it has met the conditions for customs inspection and supervision to the Customs Branch where the export processing enterprise is managed. In the case of an Investment Registration Certificate, an adjusted Investment Registration Certificate or a document from a competent investment registration agency, in case the issuance of an Investment Registration Certificate is not required, do not state The time an export processing enterprise officially comes into operation is the time the enterprise officially begins production according to the enterprise's notification to the customs authority. – After 01 year from the date of issuance of the first written confirmation from the Customs Branch, the export processing enterprise fails to notify the Customs Branch where the export processing enterprise is managed or does not meet the conditions. In case of customs inspection and supervision as prescribed in Clause 1, Article 28a of Decree No. 18/2021/ND-CP, tax policies for non-tariff zones cannot be applied. Enterprises must pay all taxes, late payment interest, and fines for imported goods that have been subject to tax policies for non-tariff zones from the date of issuance of the Investment Registration Certificate and Certificate of Investment Registration. Adjusted investment receipt or document from the competent investment registration agency in case the issuance of an Investment Registration Certificate corresponding to the new investment project or the expanded investment project is not required. meet the conditions for customs inspection and supervision as prescribed in Clause 1, Article 28a of Decree No. 18/2021/ND-CP. In case the enterprise then meets the conditions for customs inspection and supervision specified in Clause 1, Article 28a of Decree No. 18/2021/ND-CP and sends a written notification to the Customs Branch where the enterprise is managed, export processing enterprises to carry out inspection and confirmation according to the provisions of Point c of this Clause, tax policies for non-tariff zones will be applied from the date the Customs Branch where the export processing enterprise manages has a written confirmation. confirm that it has met the conditions for customs inspection and supervision as prescribed in Clause 1, Article 28a of Decree No. 18/2021/ND-CP. |

| Legal grounds | – Customs Law No. 54/2014/QH13;

– Law on Export Tax and Import Tax No. 107/2016/QH13; - Decree No 134/2016/ND-CP dated September 1, 2016 of the Government detailing a number of articles and measures to implement the Law on Export Tax and Import Tax. – Decree No. 82/2018/ND-CP dated May 22, 2018 of the Government regulating the management of industrial parks and economic zones and documents amending, supplementing and replacing (if any). – Decree No. 08/2015/ND-CP dated January 21, 2015 of the Government stipulating details and measures to implement the Customs Law and customs procedures, inspection, supervision, customs control and documents. amendments, supplements, replacements (if any).

– Clause 10, Article 1 of Decree No. 18/2021/ND-CP dated March 11, 2021 of the Government amending and supplementing a number of articles of Decree No. 134/2016/ND-CP dated September 1, 2016 of the Government detailing a number of articles and measures to implement the Law on Export Tax and Import Tax. |

| The order of execution | Step 1: At least 30 days before the export processing enterprise officially comes into operation as stated in the Investment Registration Certificate, adjusted Investment Registration Certificate (if any) or documents of the investment registration agency competent in cases where it is not required to issue an Investment Registration Certificate or a written confirmation from the investment registration agency regarding the time the export processing enterprise officially comes into operation behind schedule compared to the scheduled time. Points mentioned in the above documents, the export processing enterprise shall send a notification that it has met the conditions for customs inspection and supervision to the Customs Branch where the export processing enterprise is managed.

Step 2: CThe Customs Department that manages the export processing enterprise completes the inspection of compliance with customs inspection and supervision conditions and sends a written confirmation to the export processing enterprise on whether or not the conditions are met. customs inspection and supervision. In case an export processing enterprise receives a written confirmation that it does not meet the conditions for customs inspection and supervision, the enterprise will continue to complete the conditions for customs inspection and supervision as prescribed but within no more than 01 year. from the date the Customs Branch where the export processing enterprise manages the first written confirmation. Step 3: When the export processing enterprise has completed the prescribed customs inspection and supervision conditions, the enterprise continues to send a document to the Customs Branch where the export processing enterprise is managed, requesting the Customs Branch where the enterprise is managed. export processing re-checks customs inspection and supervision conditions according to regulations. Export processing enterprises are allowed to complete the conditions for customs inspection and supervision according to regulations multiple times but no more than 01 year from the date the Customs Branch where the export processing enterprise manages issues the first written confirmation. . Step 4: The Customs Branch where the export processing enterprise is managed is responsible for completing the re-inspection of compliance with customs inspection and supervision conditions and sending a document to the export processing enterprise regarding compliance or non-compliance. Customs inspection and supervision conditions according to regulations. |

| Profile components | Notice of completion of construction and installation of equipment to meet customs inspection and supervision conditions for the non-tariff zone according to Form No. 25, Appendix VII issued with Decree No. 18/2021/ND -CP. |

| Number of records | 01 set |

| Name of the declaration form | Form No. 25 - Notice of completion of construction and installation of equipment to meet customs inspection and supervision conditions for the non-tariff zone in Appendix VII issued with Decree No. 18/2021/ ND-CP. Form No. 26 - Certificate of satisfaction/non-satisfaction of inspection and supervision conditions of customs authorities for non-tariff zones that are export processing enterprises. |

| Attachments | 0 |

SEN TRONG LOGISTICS LOGISTICS CO., LTD

Phone: (+84) 28-2218.7777 // (+84) 28-2219.7777

Website: https://whitelotuslogistics.com.vn

Email: sales777.whitelotus@whitelotuslogistics.com.vn

Contact: Ms. Tran Thi Thuy Trang – CEO

Hotline: (+84) 903.712.368

Related Posts

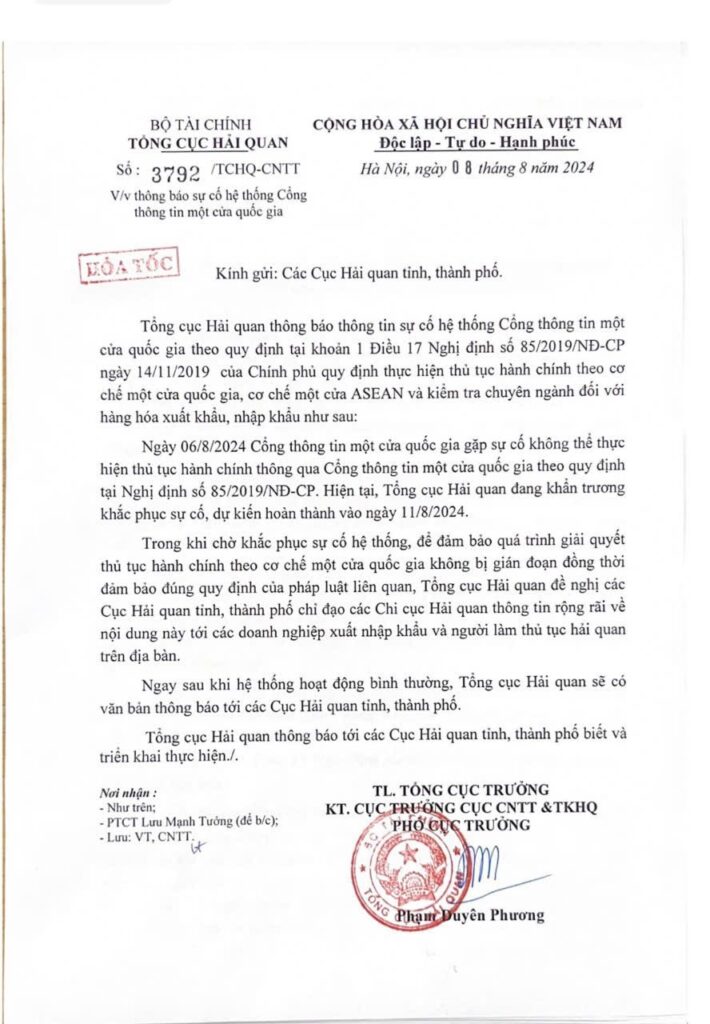

Urgent CV to notify the National Single Window Portal system incident.

VAT is further reduced by 2% until the end of this year

ABOUT TAX POLICY ...... ACCORDING TO OFFICIAL DISpatch 706/TCHQ-TXNK DATED FEBRUARY 22, 2024

NO. 01/2024/TT-BNNPTNN, February 2, 2024

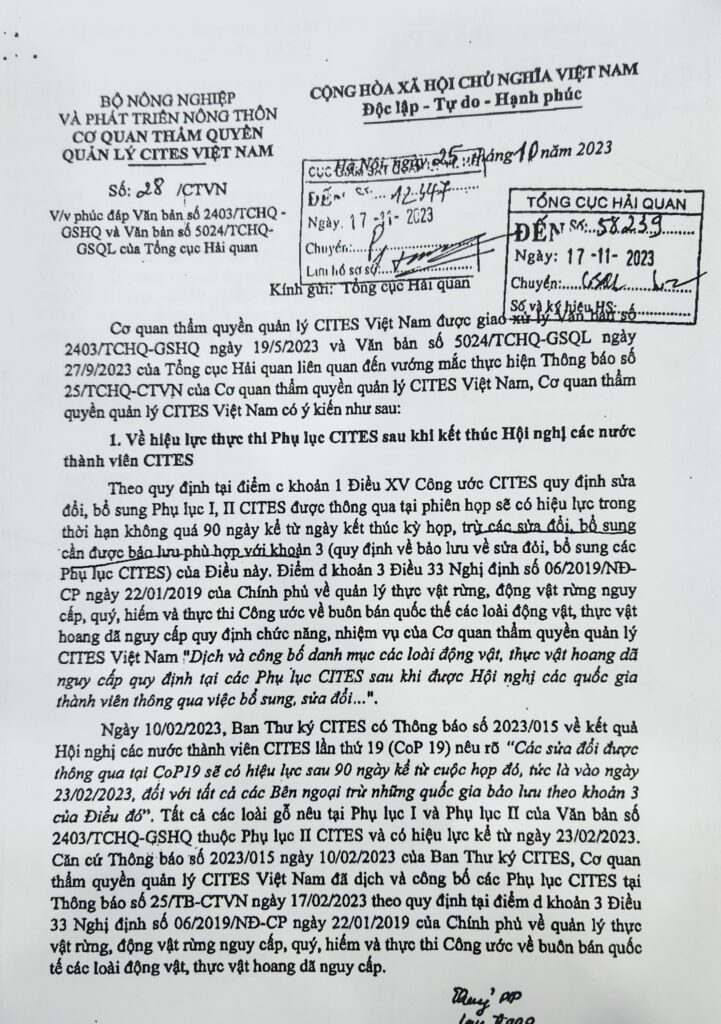

Official dispatch amending CITES

Method of calculating export tax and import tax 2024

Subjects subject to export tax and import tax 2024

Procedures for pre-determination of customs value 2024

Allocation of 2024 adjustments

Adjustments except 2024

Adjustments plus 2024

Special relationship

Whatever you need, we're here to help

Logistics solution

We meet the needs of customers of the supply chain.

Contact us

Our team of dedicated professionals is here for you.

Request a quote

Request an inland tariff quote from us.